The TL;DR for this blog post is this: We’ve been busy integrating more of your financial touch points into Fold, we’ve also been busy further automating personal finance management using machine learning.

What excited us about building Fold was the possibility of completely automating your personal finances. No more making time out at the end of the day or every week to record your transactions, trudge through finance templates on Notion or Excel, or even bloody your hands in ink. We thought pulling your transactions from your bank accounts pretty much does it, but there are two things we realised we were a bit off about.

- Your bank accounts are not the only touch point of your financial life, there are credit cards, investments,and cash transactions as well.

- Automation doesn’t end at automatically pulling your transactions at regular intervals, in fact, it’s just a start. Real automation is further enriching those transactions with metadata, like merchant and category that makes sense in your financial world.

More touch points.

The requests for being able to track credit cards started flowing in from day 2 of the announcement. There are three reasons we started work on it a little late. First, none of our team members were heavy credit card users, hence we couldn’t identify with the problem firsthand. Two, there were products already in the market providing that ability. Third, the only source of data for credit cards is email, and from our privacy standpoint, we had decided we won’t touch your inbox.

But the requests kept flowing in, at an increasing rate. We already had a good transaction and transactions tagging system in place, so it would make sense if we brought in credit cards and added the same layer of enrichment to credit card transactions as the bank transactions. A few members in our team got credit cards and started using them. This made us realize, that the problem is real (of tracking credit card expenses) and the existing products don’t do a job as well as we could.

We soon started working on integrating credit cards. Now, what do you do about never scraping your emails?

There are several things that we took into account, which also increased the development time manifolds.

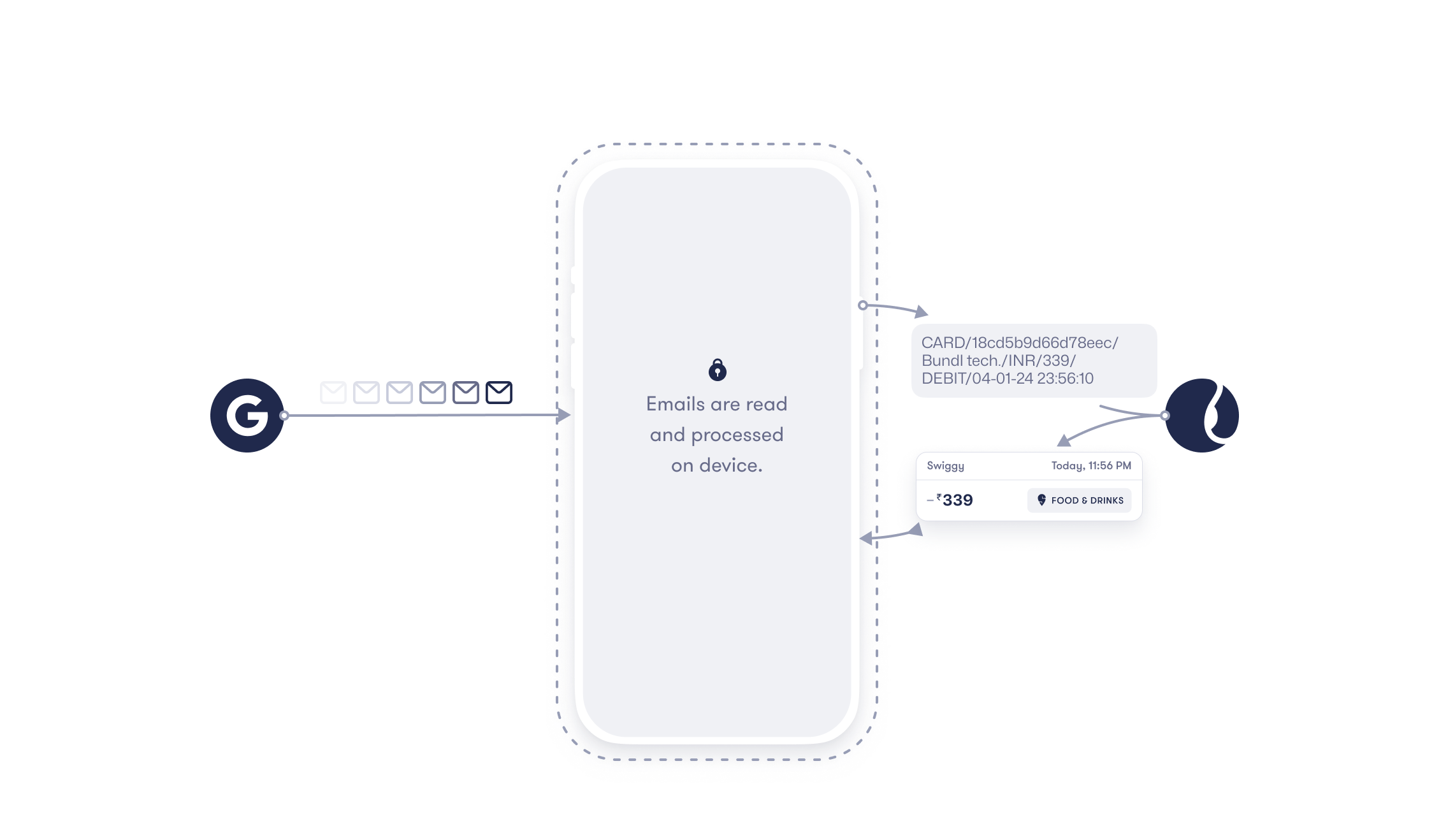

Here’s how we extract your transactions from your inbox without even touching your email or knowing which email you’re using or connected to Fold.

When you connect your Gmail account to Fold only your relevant transaction emails are pulled to your device and processed locally, from there, data from transaction emails like amount, merchant, and time is sent to our servers for storage and enrichment. Our servers don’t get a whiff of your email address or any other emails in your inbox.

Currently, when you connect a new credit card, to verify and extract data like cycle date, amount due, and last digits we parse your PDF statement. This parsing also happens locally on your device. However, we have faced issues with iOS and Android native parsing to be honest, which has added to development and testing time.

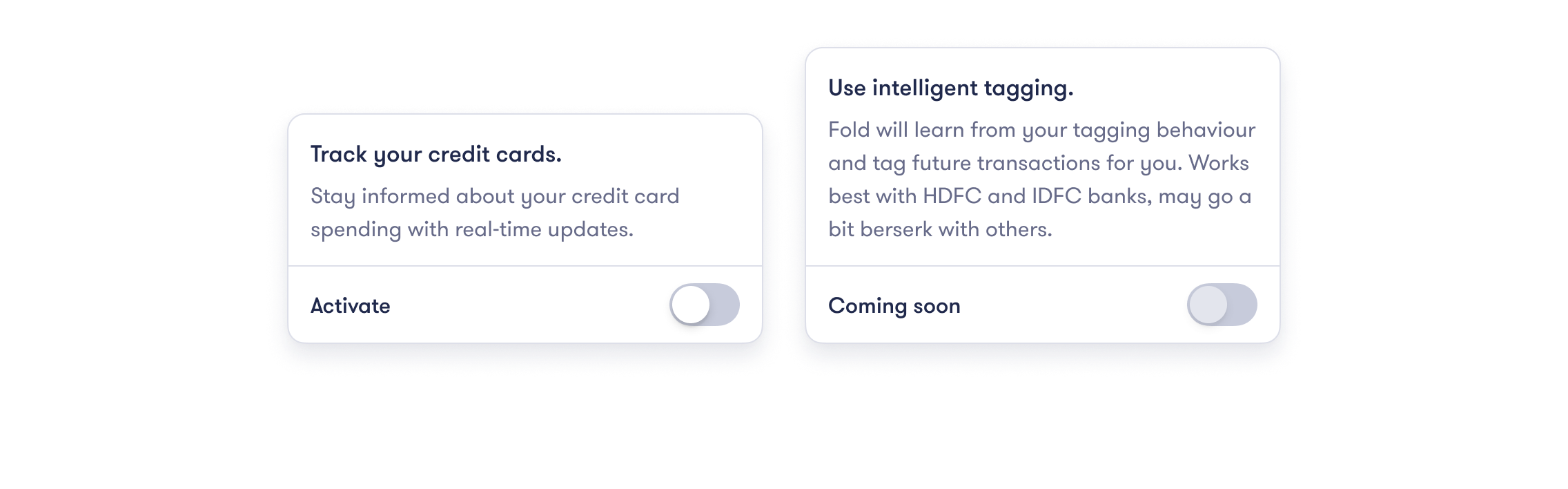

Fold as of now supports these credit cards. We’re making credit card connections public but only through a toggle that you have to turn on in Settings → Beta Playground → Track credit cards. This will reveal more edge cases and feature requests that we can implement before going fully public with credit cards. Currently, credit card tracking is available only on iOS, next week we’re launching credit card tracking for Android users on our Discord.

Existing credit card tracking tools only go a few miles when it comes to giving you a comprehensive picture of your finances. We go all the way, from the granular insights like tags, merchant, date, and time to the big picture like quick access to bill paid transactions, past cycle’s history, refund tracking, subscriptions, and spending summary.

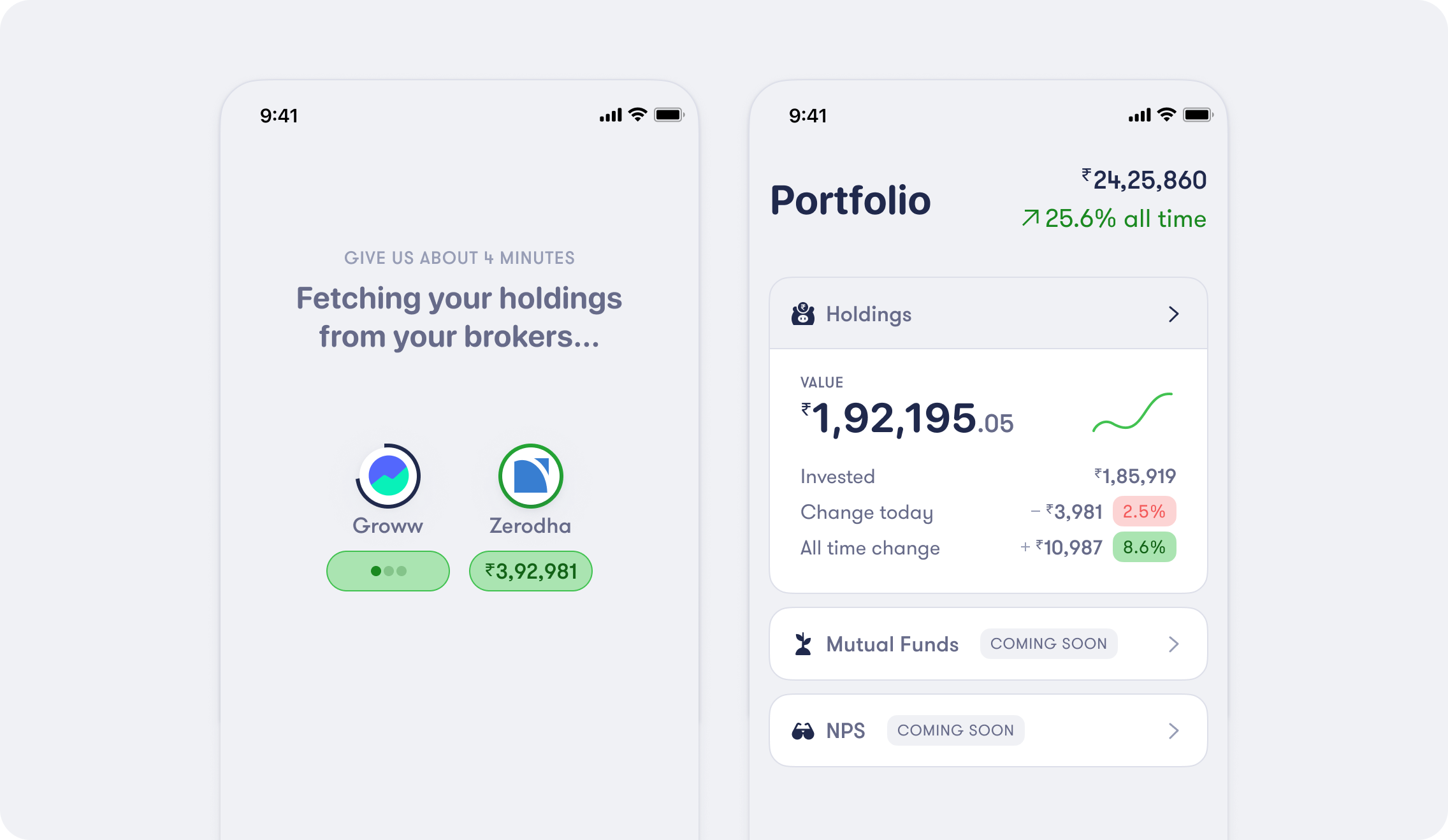

Another important part of finance besides credit cards and bank accounts, is investments. Of which the two most important ones are your Stock holdings and mutual fund investments. Both of these are being integrated into the app as well. With your credit cards, bank accounts and investments Fold should be able to help you have a clear picture of about 90% of your financial life. The rest 10% like EPF, PPF, insurance, NPS e.t.c are also something we hope to integrate soon.

Automating personal finance - for real.

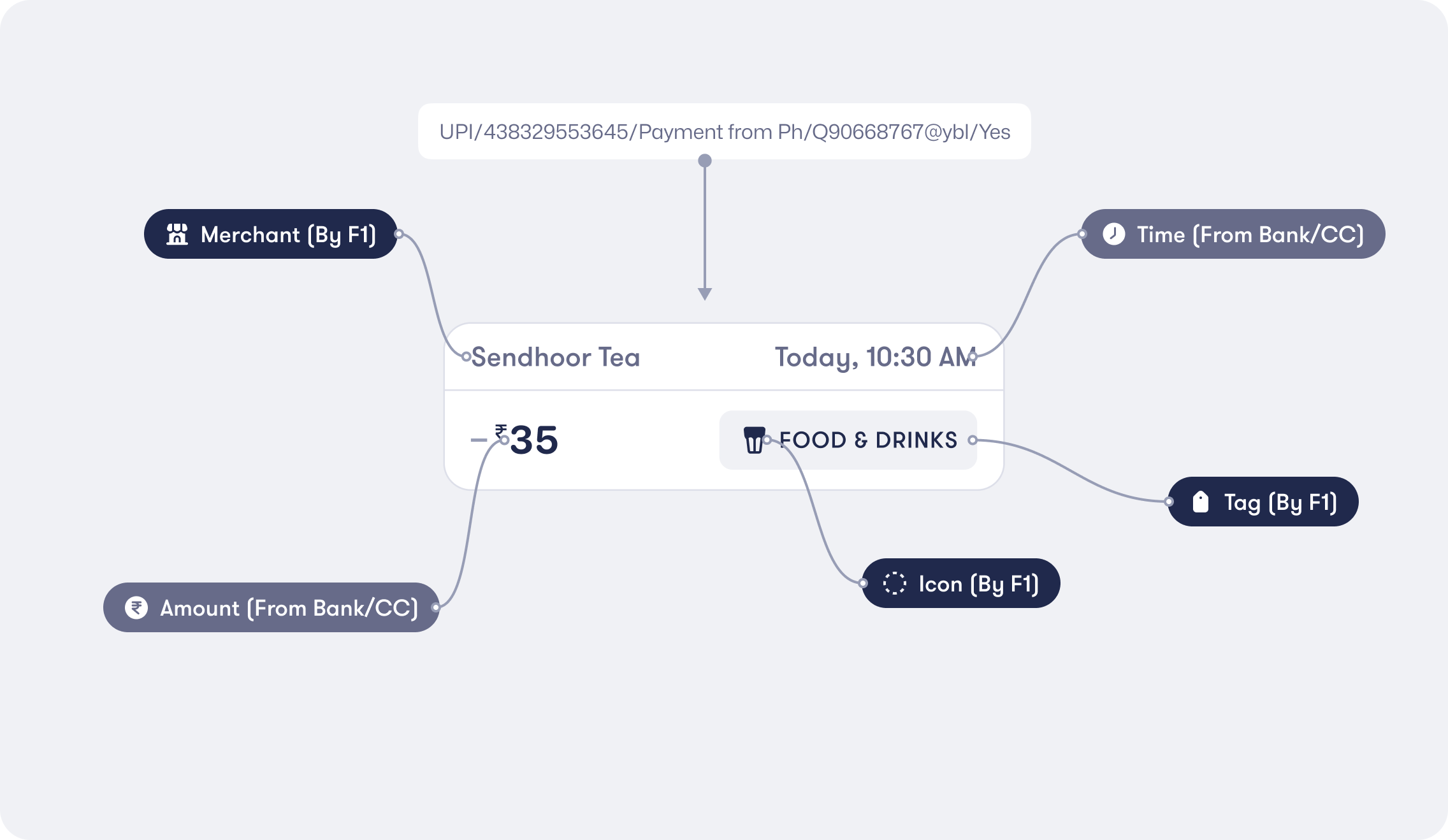

Fold’s categorization isn’t just a surface-level categorization, it’s a bit deeper. For example, if you have a transaction that’s categorized as shopping, you can further break it down into shopping for books, clothes, furniture etc.

With this amount of granularity each transaction carries with itself the whole story, the entire context, not just some gibberish like, UPI/438329553645/Payment from Ph/Q90668767@ybl/Yes

Across 38 categories we have 163 icons or subcategories that are available to provide added context to your transactions.

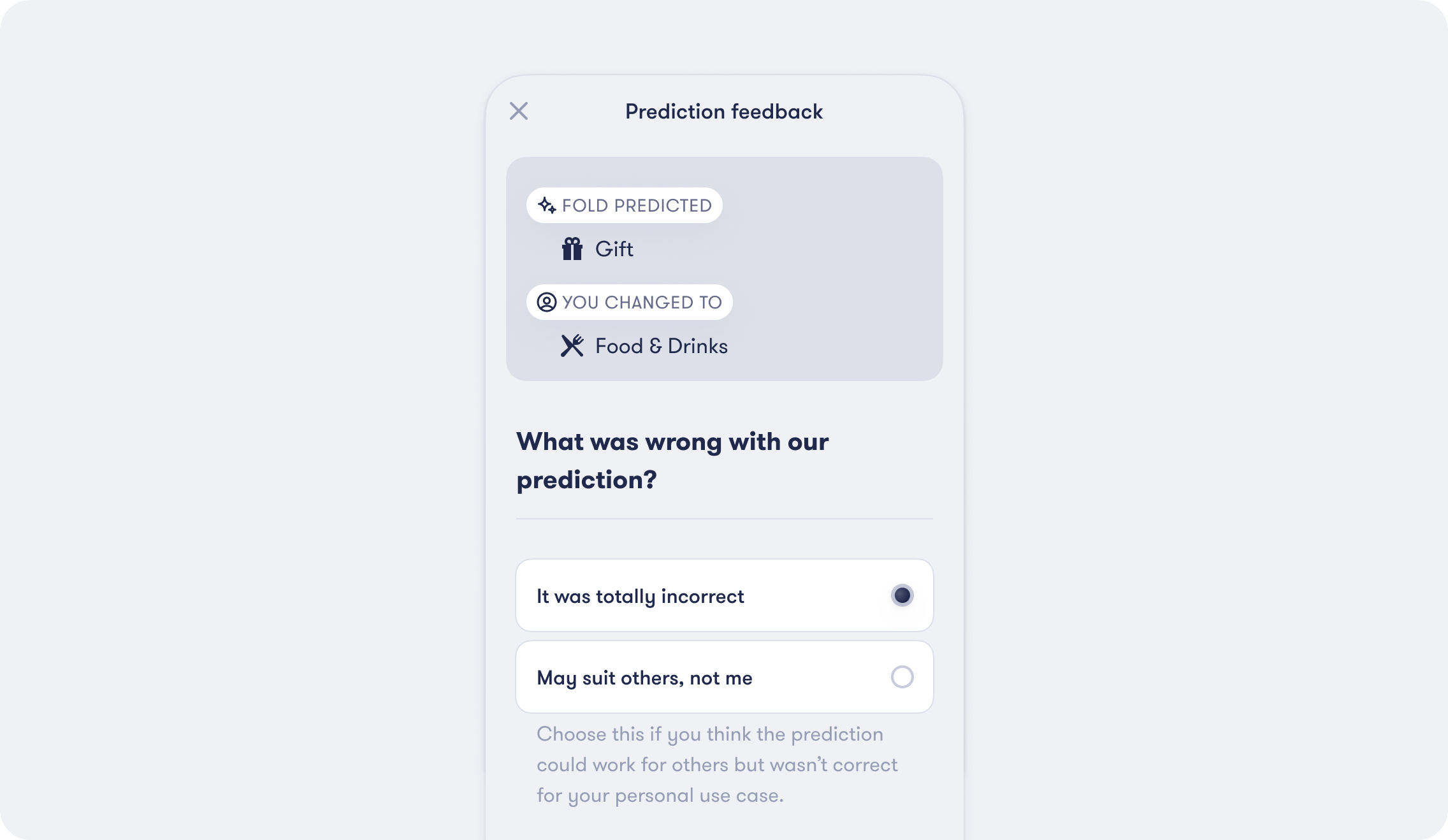

With this number also comes the challenge of picking and properly attaching an icon to a transaction, automatically. A technical deep dive into our categorisation engine F1 can be read here.

I have tested our categorization engine (F1) over the past few months. My initial days of using Fold went something like this, I got a notification that certain new transactions were fetched, I went into the app saw some 5 new transactions, tried to remember their purpose then added metadata (merchant, icon, tag), and then moved on. Sometime during the last month, this started to change.

I got a notification and saw some 5 new transactions, one of which had all the correct metadata figured out by F1 itself. This was a glimpse into the future of truly automating personal finance. Figuring out the purpose of the transaction and where it’s spent consequentially also automatically figures out your insights, without you having to manually do much. The number of transactions after each refresh with all the added metadata has only increased as time has gone by.

We’re not still 100% there, and the engine will ask you for feedback here and there on how it’s doing. We’ll be piloting this feature for all beta testers in February, and we can’t wait for everyone to try this.

And goes without saying, F1 also perfectly works with credit card transactions.

One more thing...

As our team and early adopters have used Fold over the past few months, one thing has become clear : One transaction won’t always be for a specific tag or icon. Money spent at a mall can be for clothes and shoes, or money spent at a pet shop can be for toys, food, and something else.

We’re working on something that will allow you to spawn new transactions from existing ones. Each behaving as a standalone transaction with its own tag, merchant, and notes. This will help in better tracking refunds from merchants and from friends and loved ones who pay back in tranches.

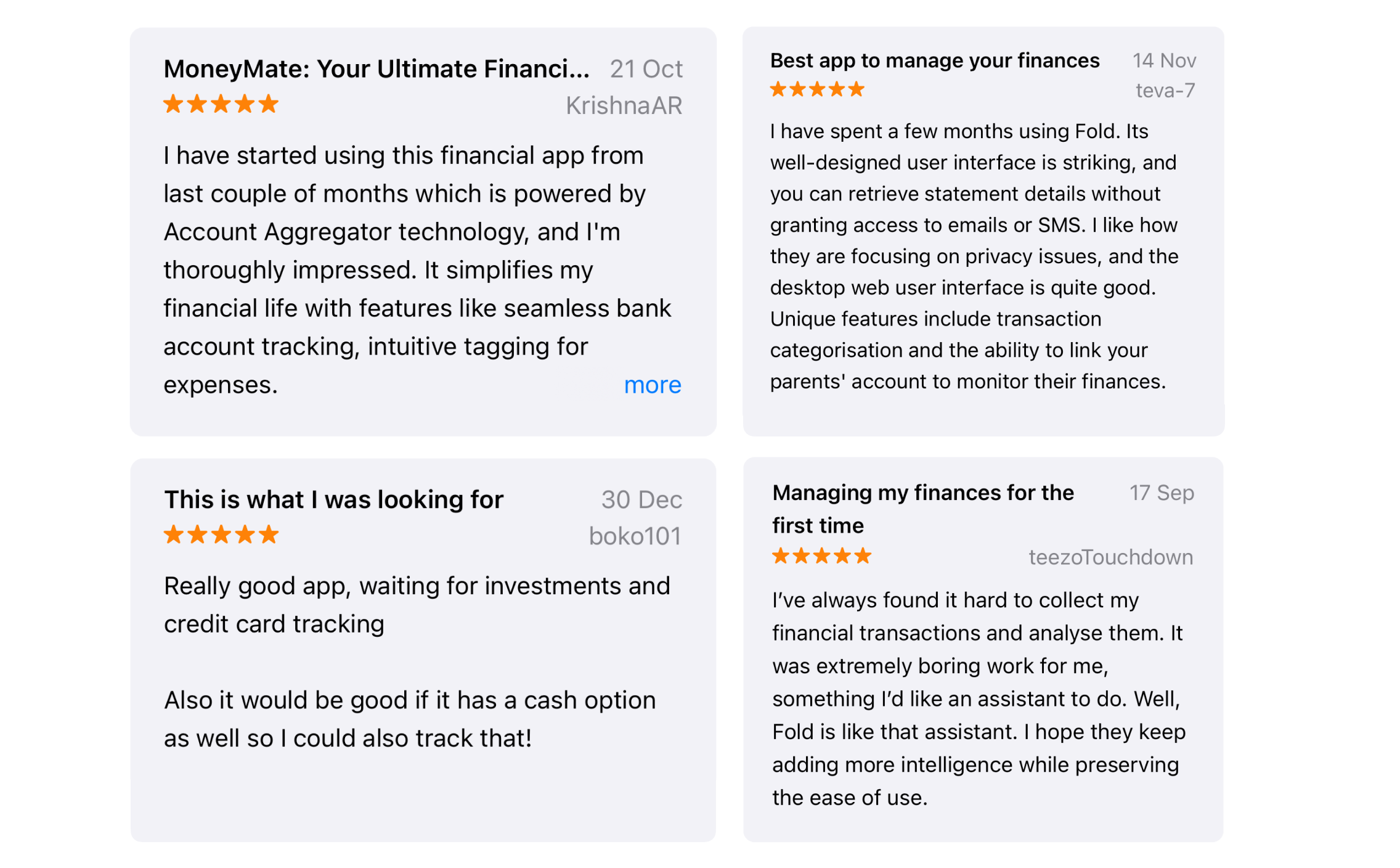

For the last few months we’ve been in put your head down, and get shit done mode. This is also why you might have noticed fewer social media posts from our handles. All the work we’ve done has started to come together, becoming something truly magical. We wouldn’t have been able to do it in a silo inside our office. We’ve been blessed with some amazing early adopters and beta testers. Our Discord is constantly buzzing with bug reports and feature requests. Everything in the app has a direct connection to some conversation on our Discord.

If you’re already there contributing to the conversations, thank you. If you’re not, join us!

As far as Account Aggregator and Banks are concerned, certain banks have been performing consistently well, which gives us confidence in the infrastructure. Fold has received a good amount of feedback and reviews which gives us confidence in the product. With that confidence, we are quite close to removing the invite wall altogether and welcoming a whole new segment of people to the world of automated and delightful personal finance management.

Update: Feb 29, 2024

Credit Card tracking is also available on Android.