F1 is our in-house transaction categorisation engine that among other things helps you make sense of your bank statements.

Based on a quick glance at any of your bank statement it’s easy to see that 80% of it is jargon and strings of alphanumeric characters that store information which computers can understand but don’t really mean much to a person.

F1 can decipher often-confusing bank statements to figure out merchants and categorise each transaction to an appropriate user-editable category. This gives a clear picture of exactly where your money is going which in turn helps you in making more informed financial decisions.

F1 is an in-house engine by Fold. We discovered that existing categorisation services lack granular details and are not optimised for the Indian market, especially for UPI transactions which are on a meteoric rise. It took us trials and errors and many different approaches before we could finally ship v1 of the F1 engine.

Some of the features of F1 include:

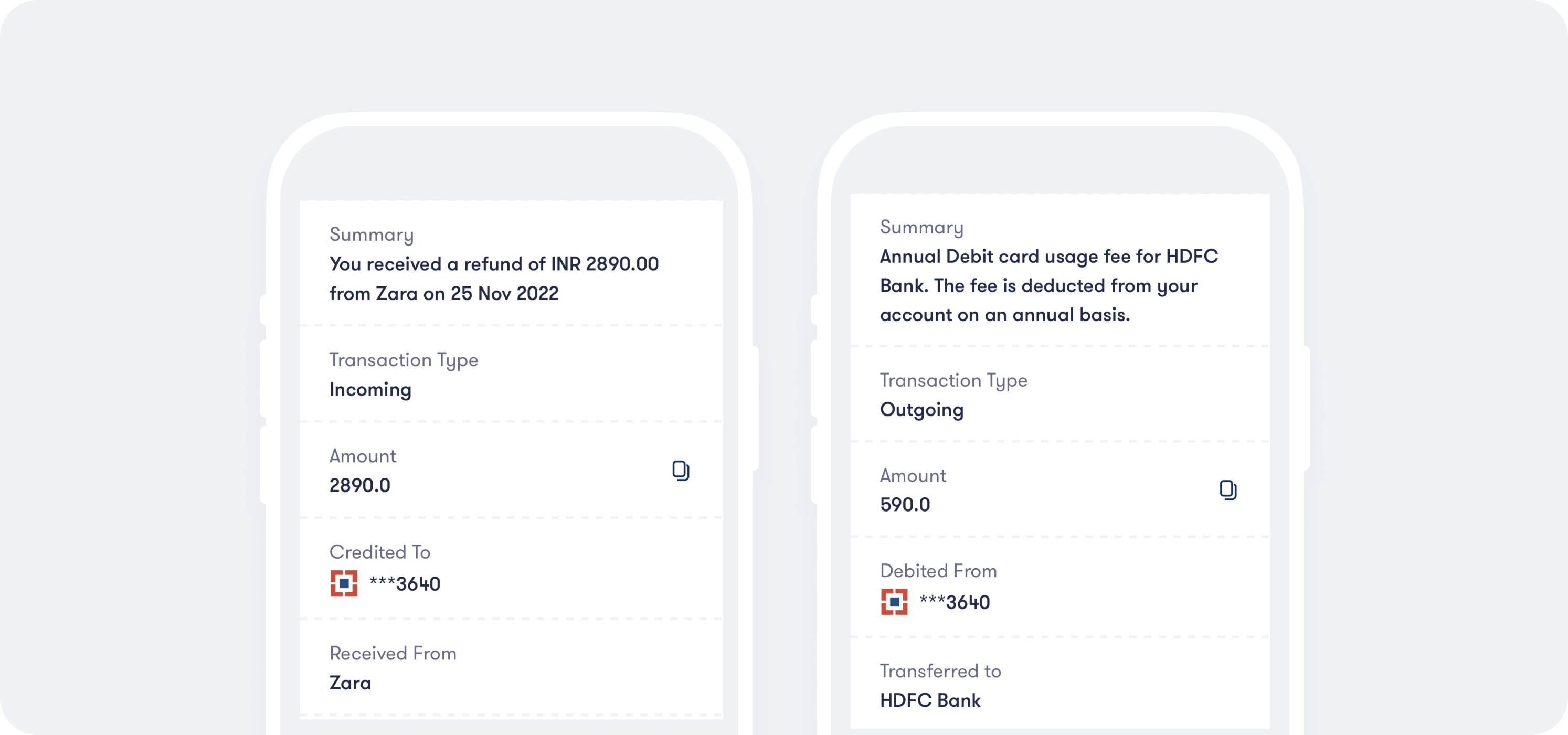

The story behind each transaction a.k.a. “Transaction Summary”

F1 can identify meaningful summary from transactions and show it in a way that people other than bank employees (us) can understand. Here is an example -

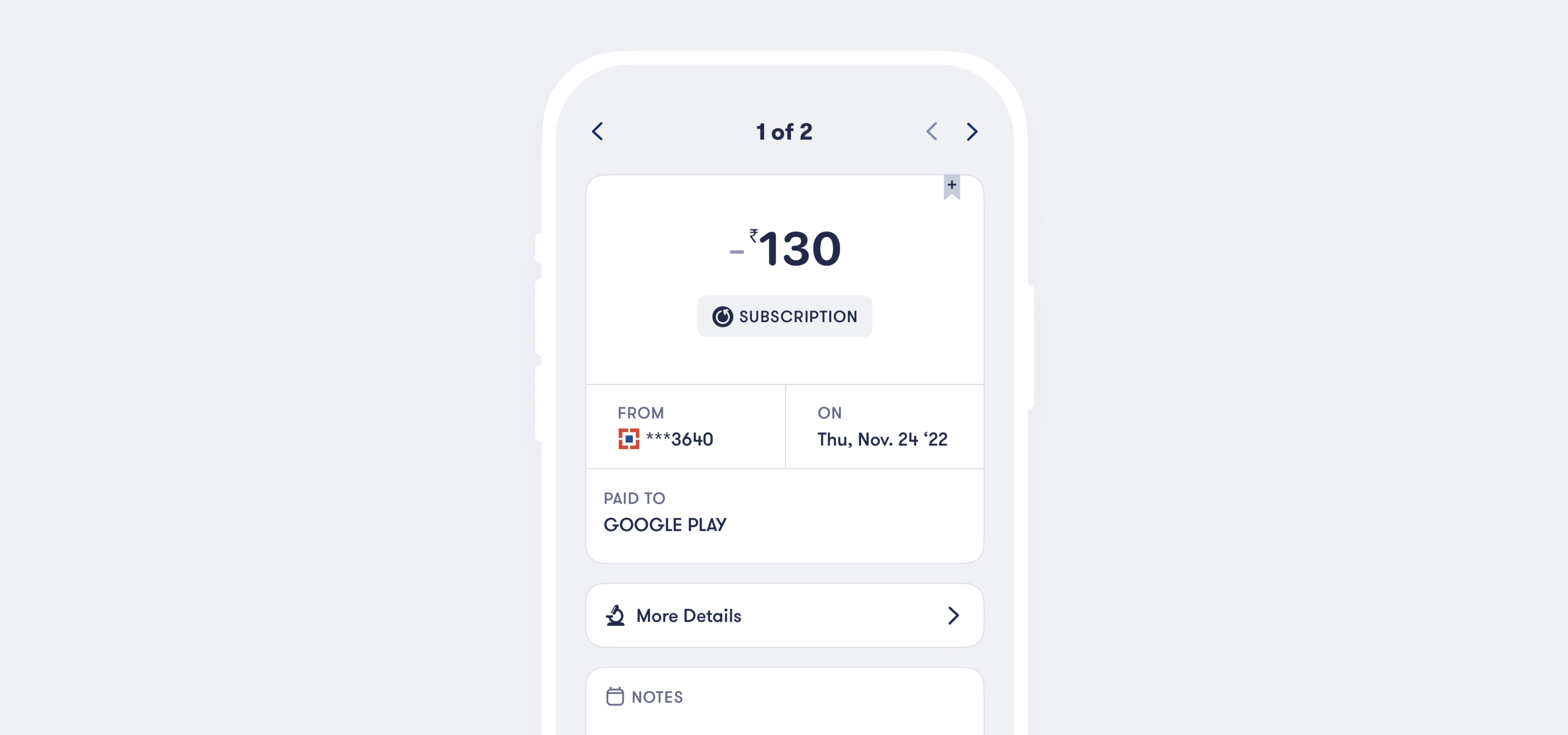

Subscriptions and recurring transactions

F1 can identify and help you track your subscriptions like YouTube, Google, Netflix, Hotstar, Apple etc. along with recurring bills, like house rent, EMIs and other utility bills.

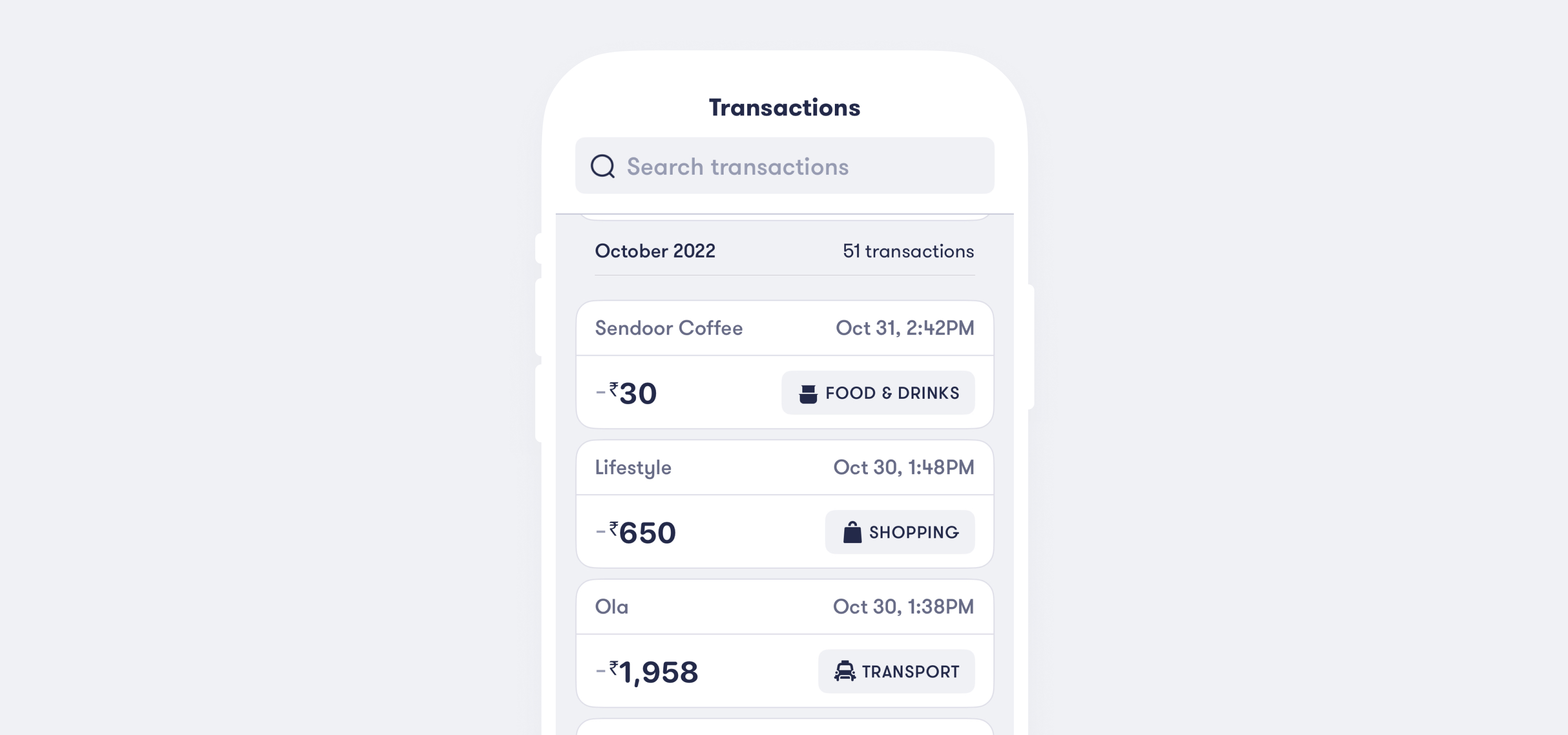

Automatic categorisation and merchant identification

No matter the type - F1 will do the heavy lifting of identifying the merchants and automatically categorise each transaction, along with an added appropriate icon, each handcrafted in-house.

People can also manually add merchants and categorise transactions for cases where F1 couldn’t figure out or gets it wrong. This will help F1 learn and it will not repeat the same in future.

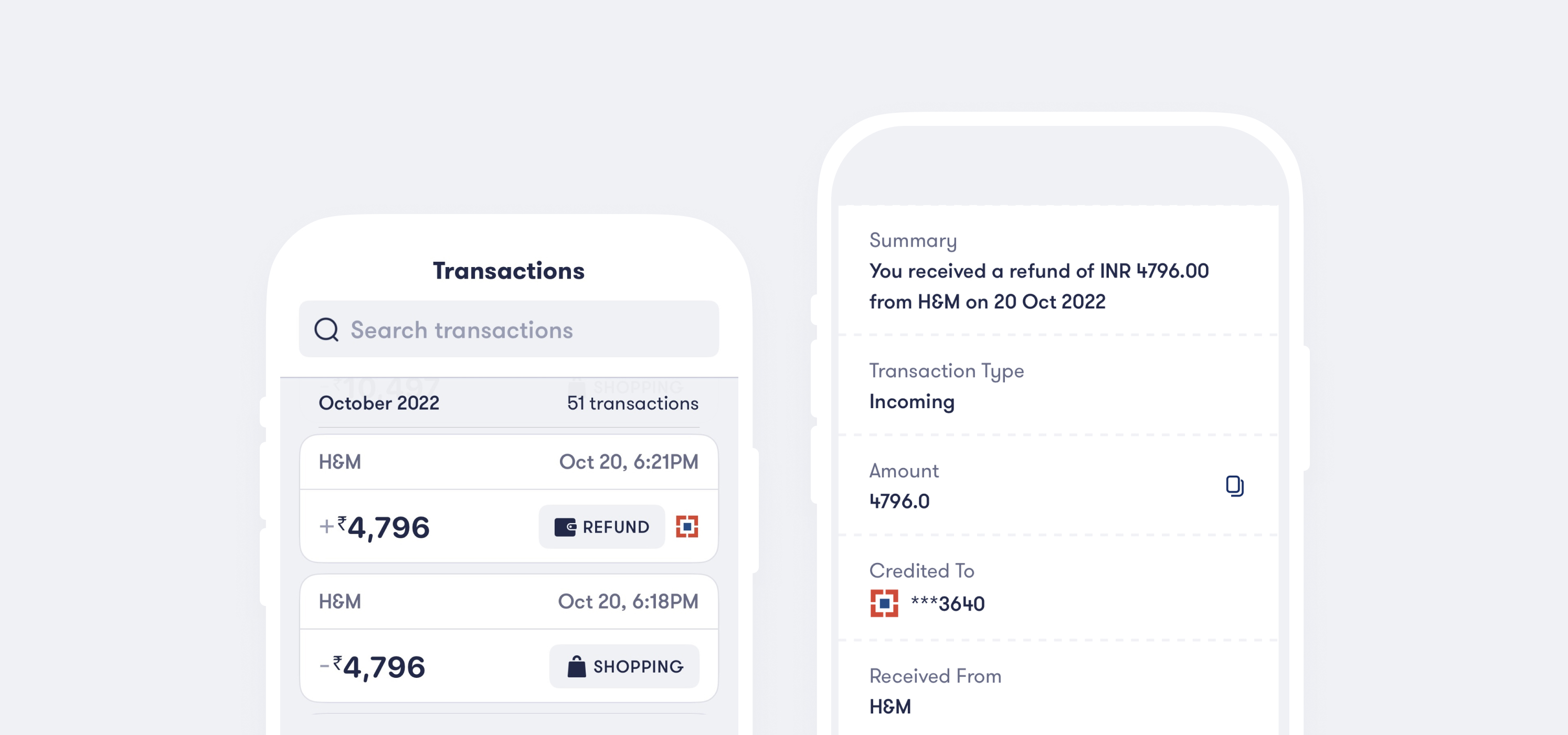

Tracking Refunds

With F1, you can mark a transaction as refundable and it will let you know when you receive a refund for the marked transaction.

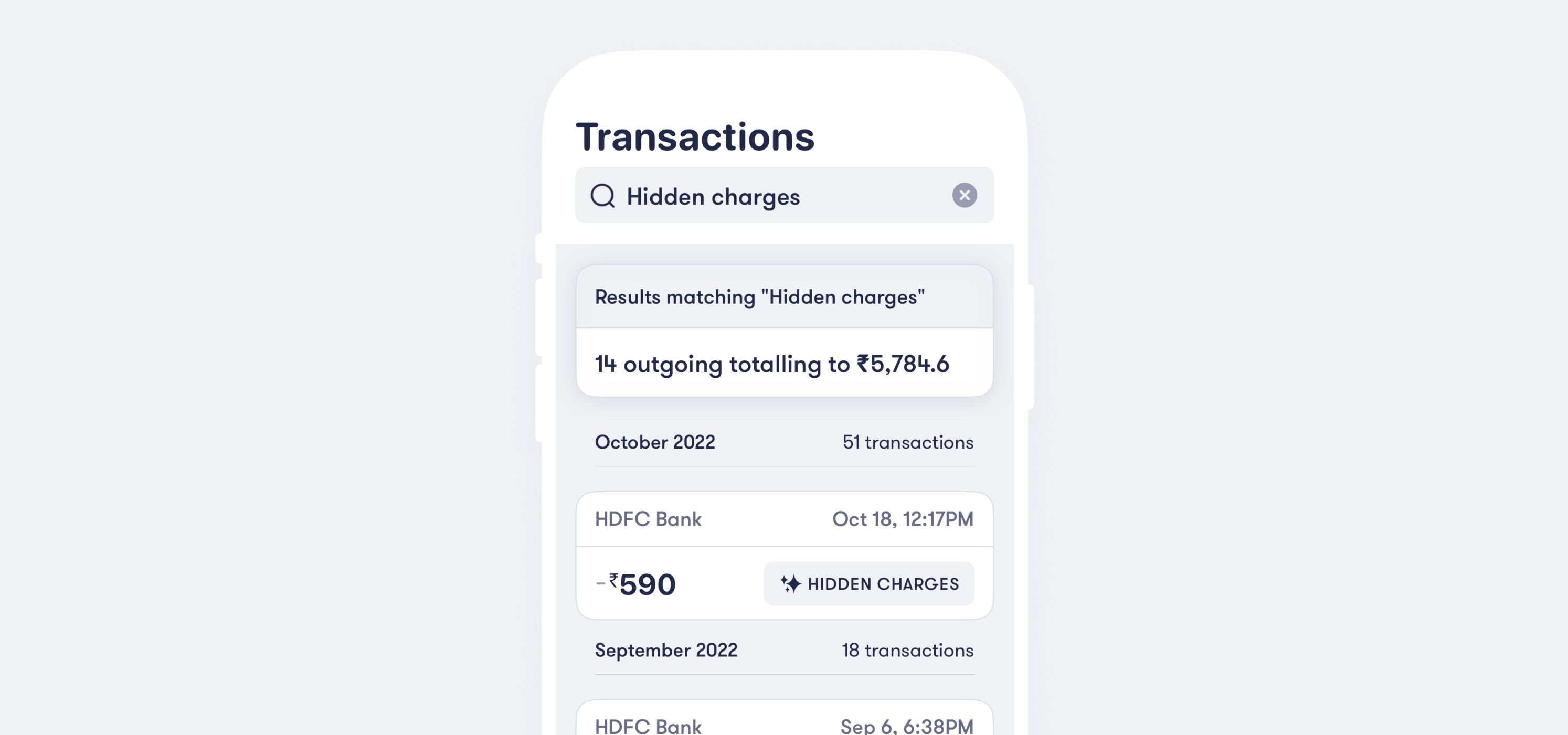

Hidden charges

Been confused by those random deductions? Turns out most of these deductions are charges from the bank themself. F1 can identify and mark all such transactions so you can see how much hidden charges you are paying for your lifetime-free bank account.

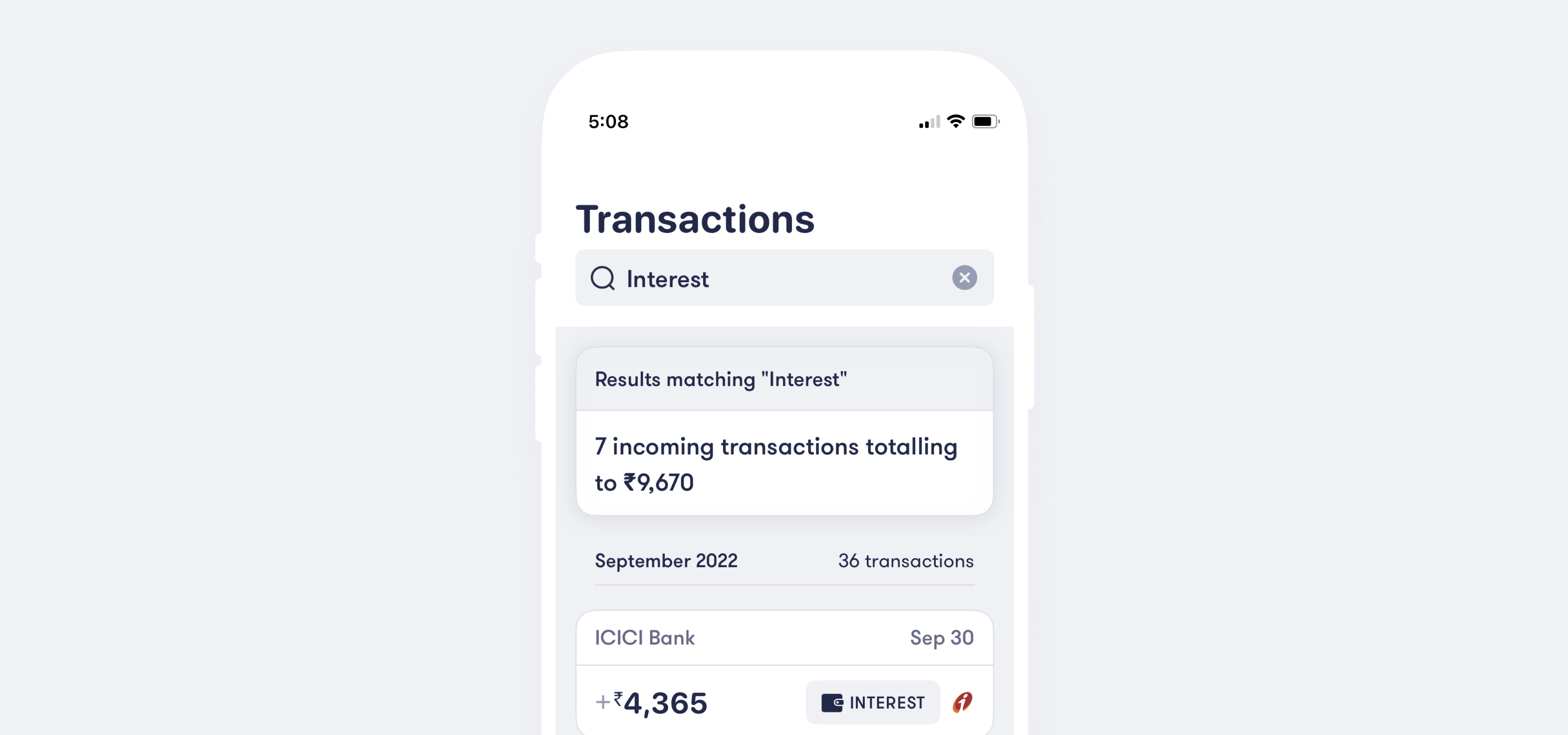

Interests

Hidden charges aside F1 also identifies interests that your banks deposits into your account.

Above are just a few of the things F1 is capable of. F1 can also provide insights about your salary, transaction mode, and the locations (if given permission) where you spent your money.

It’s your money. You should know where it’s coming from, where it is going, and everything you can do to save it and make it grow.

What's next for F1?

It’s a long road ahead for F1 and a lot more features to build. We’re right at the starting line, as F1 grows it will learn and adapt, becoming even more effective at helping the general population with their finances and financial decisions.

If F1 piques your interest as an end user or as an engineer, write to us we would love to discuss - [email protected].